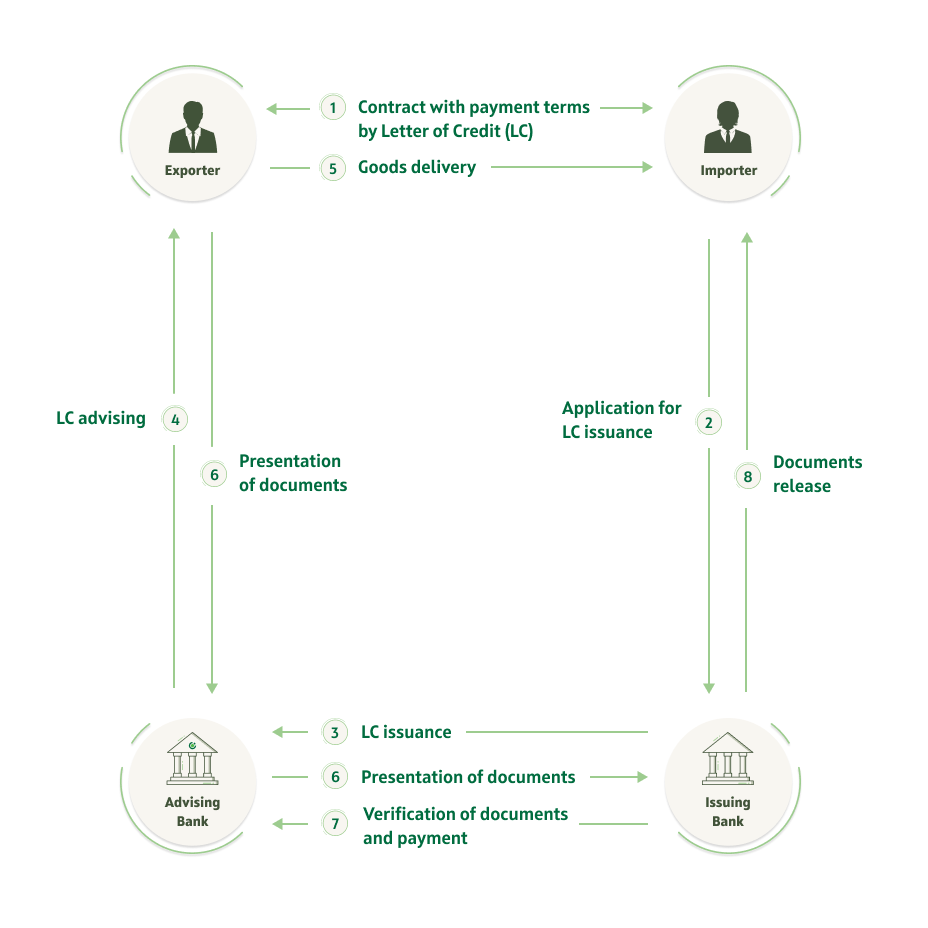

Choose documentary letters of credit to ensure that international payments are made with the highest degree of security.

Protect your business from the financial, commercial and political risks that can occur in an import/export transaction.

Whether you are a beneficiary or applicant of a letter of credit, you can benefit from professional advice.

.jpg)